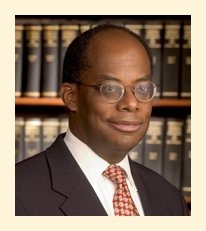

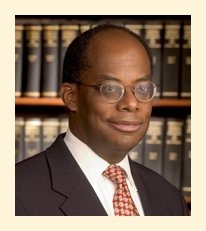

Fed Reserve Vice Chairman Dr. Roger Ferguson, A Voting Member of The FOMC, Resigns; Prime Rate Increase Still Likely In 3 Weeks

Dr. Roger W. Ferguson announced that he will be resigning his post as Vice Chairman of The Federal Reserve Board effective April 28, 2006. As a Fed governor, Dr. Ferguson has been a voting member of the interest rate setting Federal Open Market Committee (FOMC)--all Fed governors are voting members of the FOMC. As is the custom with exiting Fed governors, Ferguson won't vote in the next FOMC meeting, which is scheduled to take place on March 28, 2006.

Appointed to the Fed board by President Bill Clinton back in 1997, Dr. Ferguson became a shining star within the Federal Reserve system when the terrorist attacks of September 11, 2001 happened: Ferguson was the only Fed governor in Washington, D.C. during the attacks (Alan Greenspan was vacationing in Switzerland at the time); Ferguson was at his post, and doing his job very well, providing liquidity for the nation's markets during that economically stressful time. The day after the September 11 attacks, the Fed loaned $46 billion to commercial banks around the country, which, at the time, was more than 200 times the daily overnight loan average.

when the terrorist attacks of September 11, 2001 happened: Ferguson was the only Fed governor in Washington, D.C. during the attacks (Alan Greenspan was vacationing in Switzerland at the time); Ferguson was at his post, and doing his job very well, providing liquidity for the nation's markets during that economically stressful time. The day after the September 11 attacks, the Fed loaned $46 billion to commercial banks around the country, which, at the time, was more than 200 times the daily overnight loan average.

Dr. Ferguson is well respected throughout the political, banking and investing communities, and I think it's safe to write that he will be missed by a wide range of folks.

Click here to view the official Fed statement related to Dr. Ferguson's resignation.

Click here to view Dr. Ferguson's resignation letter.

Dr. Ferguson recently spoke at Howard University; here are some snippets from his speech:

I think that Ferguson's comments about the current inversion of U.S. Treasury Note yields is very significant. Right now, yields are slightly inverted, and an inversion of Treasury Note yields has often preceded an economic slowdown in the U.S. However, the inversion that we are seeing right now is actually being caused by "relatively low long-term yields" and not by relatively high short-term yields, and, in the past, it was the inversions caused by relatively high short-term yields that have often preceded an economic downturn.

With the next FOMC meeting taking place in about 3 weeks, and the U.S. economy continuing to move forward, another 25 basis point increase to The Federal Funds Target Rate is still very likely on March 28, 2006. (that would, of course, translate to a quarter point increase to the U.S. prime rate, a.k.a. the published Wall Street Journal® prime rate.)

The current published U.S. Prime Rate is 7.5%, and an increase to 7.75% is expected on March 28TH, 2006.

Appointed to the Fed board by President Bill Clinton back in 1997, Dr. Ferguson became a shining star within the Federal Reserve system

when the terrorist attacks of September 11, 2001 happened: Ferguson was the only Fed governor in Washington, D.C. during the attacks (Alan Greenspan was vacationing in Switzerland at the time); Ferguson was at his post, and doing his job very well, providing liquidity for the nation's markets during that economically stressful time. The day after the September 11 attacks, the Fed loaned $46 billion to commercial banks around the country, which, at the time, was more than 200 times the daily overnight loan average.

when the terrorist attacks of September 11, 2001 happened: Ferguson was the only Fed governor in Washington, D.C. during the attacks (Alan Greenspan was vacationing in Switzerland at the time); Ferguson was at his post, and doing his job very well, providing liquidity for the nation's markets during that economically stressful time. The day after the September 11 attacks, the Fed loaned $46 billion to commercial banks around the country, which, at the time, was more than 200 times the daily overnight loan average.Dr. Ferguson is well respected throughout the political, banking and investing communities, and I think it's safe to write that he will be missed by a wide range of folks.

Click here to view the official Fed statement related to Dr. Ferguson's resignation.

Click here to view Dr. Ferguson's resignation letter.

Dr. Ferguson recently spoke at Howard University; here are some snippets from his speech:

"...Indeed, the most recent data suggest that economic activity in 2006 is off to a solid start...

...All told, increases in energy prices over the past couple of years probably added about 1/2 percentage point to core inflation in 2005, and the lagged pass-through of past increases in energy prices appears likely to add roughly the same amount this year, provided that energy prices do not rise significantly further...

...Another development that has received considerable attention recently is the term structure of interest rates--the yield curve. Typically, longer-term interest rates are higher than short-term rates, so a curve plotting yields would rise as maturity lengthens. However, since late last fall, yields on longer maturities have been equal to or less than those at some shorter maturities, creating a flat to inverted yield curve. Going back to the 1950s, a simple picture suggests that the yield curve tends to invert before recessions. In addition, some academic research, along with recent market commentary, suggests that the shape of the yield curve is a strong predictor of future economic growth.

However, the Treasury yield curve is now only slightly inverted between one and five years and is roughly flat beyond that. Moreover, yield curves can be flat or inverted either because short-term interest yields are relatively high or because long-term rates are relatively low. Historically, flat or inverted yield curves owing to unusually high short-term rates have tended to be followed by slowdowns, but that has not been the case for those episodes of inverted yield curves owing to relatively low long-term rates. And, in the current situation, the flatness of the term structure results largely from relatively low long-term yields...

...All told, the U.S. economic expansion appears to be solidly on track. Nevertheless, the outlook for real activity faces a number of significant risks, including the possibility that house prices and construction could retrench sharply and that energy prices could rise significantly further...

...Given the limits of what we know about the future path of housing prices and about the implications of any particular house-price scenario for real activity, the Federal Reserve will have to continue monitoring this area closely...

...In the current situation, the economic expansion appears to be on track and core inflation has remained moderate. As I indicated, significant risks, if realized, could alter this generally sanguine outlook, and the Federal Reserve will continue to monitor developments closely. Given the considerable uncertainties facing the economy and the outlook for policy, policy decisions in coming months will depend heavily on the implications of incoming economic data for future growth and inflation."

I think that Ferguson's comments about the current inversion of U.S. Treasury Note yields is very significant. Right now, yields are slightly inverted, and an inversion of Treasury Note yields has often preceded an economic slowdown in the U.S. However, the inversion that we are seeing right now is actually being caused by "relatively low long-term yields" and not by relatively high short-term yields, and, in the past, it was the inversions caused by relatively high short-term yields that have often preceded an economic downturn.

With the next FOMC meeting taking place in about 3 weeks, and the U.S. economy continuing to move forward, another 25 basis point increase to The Federal Funds Target Rate is still very likely on March 28, 2006. (that would, of course, translate to a quarter point increase to the U.S. prime rate, a.k.a. the published Wall Street Journal® prime rate.)

The current published U.S. Prime Rate is 7.5%, and an increase to 7.75% is expected on March 28TH, 2006.

|

--> www.FedPrimeRate.com Privacy Policy <--

--> www.FedPrimeRate.com Privacy Policy -- BACKUP<-- CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

<< Home