Probability of A Rate Cut for The March 21, 2007 FOMC Monetary Policy Meeting Is Now At 79%

The U.S. economy is still sending mixed signals. For example, Gross Domestic Product (GDP) for the third-quarter was recently revised up from 1.6% to 2.2%, and the most recent Beige Book report from the Fed indicates that most of the country is still enjoying moderate growth. On the flip side, consumer confidence continues on a downward trend, and orders for durable goods fell by 8.3% last month. Furthermore, we may still have to worry about inflation. Here's a clip from a recent speech made by Fed boss Ben Bernanke before the National Italian American Foundation in New York:

Housing Sector Continues to Slide

More evidence that the housing market is still sliding came in this week:

When will the housing correction bottom out? No one knows for sure (of course, if you're in the market for a new home, then the current housing situation is good news, especially because the inventory of new and existing homes continues to rise, and mortgage rates are still consumer-friendly.)

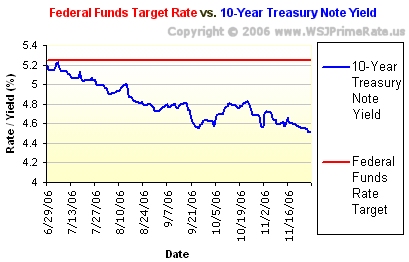

10-Years Treasury Note Yield vs. The Federal Funds Target Rate

President Bush's economic advisers recently lowered their expectations for GDP growth next year: the 2007 GDP forecast is 2.9% right now, whereas, back in June, the same group of advisers were predicting 3.6% growth for 2007. Basically, the forecast is for strong growth throughout the economy, except for the U.S. housing market.

2.9% is a decent number, especially if inflation remains tame. So maybe Bernanke and his Fed colleagues have raised rates to just the right level, i.e. the neutral rate (the neutral rate is a Fed Funds Target Rate that neither stimulates nor inhibits U.S. economic growth, and is the rate that's associated with a stable U.S. economy.)

Or, maybe not.

Maybe today's Fed Funds Target Rate of 5.25% is a bit above neutral, which would mean that the Fed may elect to lower the Fed Funds Target to 5% some time next year. That's what investors are thinking.

When investors foresee an economic slowdown ahead, they tend to move their money from stocks to the relative safety of government treasuries. As the demand for e.g. 10-year treasury notes rises, the yield on the 10-year note -- i.e. the interest paid to the investor -- falls (and vice versa.)

Treasury yields are great indicators of where the economy is headed, especially when the yield on the ten-year note is compared to the Federal Funds Target Rate. If the yield on the 10-year note is trending lower than the Fed Funds Rate Target, then it's a pretty safe bet that the economy will be slowing in the coming months. The difference between the Fed Funds Target Rate and the 10-year treasury yield is known as the "spread."

The last time the Fed started cutting interest rates (so as to spur economic growth) was on January 3, 2001; on that day, the Fed Funds Target Rate was 6%, and the yield on the 10-year treasury note was 4.92%. That's a spread of 1.08 percentage points.

Right now, the spread is 0.792 percentage points, and it's been widening ever since June 29, 2006; June 29 was the date of the last Fed rate hike. Here's a chart to demonstrate the current trend:

If the gap between the 10-year treasury note yield and the Fed Funds Target Rate continues to widen, then the U.S. economy is more likely to cool in the coming months, which, in turn, would make it more likely that the Fed will elect to lower interest rates in 2007.

The Latest Odds

As of right now, the investors who trade in Fed Funds Futures have odds at around 79% (according to current pricing on contracts) that the Federal Open Market Committee (FOMC) will elect to lower the benchmark Fed Funds Target Rate by 25 basis points at the March 21ST, 2007 monetary policy meeting.

Summary of the Latest Prime Rate Predictions:

The odds related to Fed Funds Futures contracts -- widely accepted as the best predictor of where the FOMC will take the benchmark Fed Funds Target Rate -- are continually changing, so stay tuned for the latest odds. Odds may experience a significant shift on the release of the following economic report:

"...Looking forward, core inflation seems likely to moderate gradually over the next year or so. Some of the factors that pushed up core inflation in the recent past--in particular, energy prices and shelter costs--appear likely to be more neutral in the coming year, and inflation expectations remain contained. Moreover, if, as seems most probable, the economy grows at a rate modestly below its potential for a time, pressures on resource utilization should ease a bit.

However, as with the outlook for economic activity, there are substantial uncertainties about the inflation forecast. In the case of inflation, the risks to the forecast seem primarily to the upside. Given the current level of inflation, a failure of inflation to moderate as expected would be especially troublesome..."

Housing Sector Continues to Slide

More evidence that the housing market is still sliding came in this week:

- Tuesday's Existing Home Sales report for October, '06 showed that preowned-home sales enjoyed a modest gain last month, and the sales numbers also beat economists' expectations. But the median sale price on a used home was down by a very significant 3.5% when compared to used-home sales from October, 2005.

- Wednesday's New Home Sales report for October, '06 showed that sales of newly-built homes are down when compared to September, 2006, and are down significantly when compared to new home sales from September, 2005.

When will the housing correction bottom out? No one knows for sure (of course, if you're in the market for a new home, then the current housing situation is good news, especially because the inventory of new and existing homes continues to rise, and mortgage rates are still consumer-friendly.)

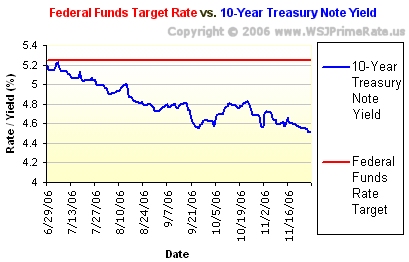

10-Years Treasury Note Yield vs. The Federal Funds Target Rate

President Bush's economic advisers recently lowered their expectations for GDP growth next year: the 2007 GDP forecast is 2.9% right now, whereas, back in June, the same group of advisers were predicting 3.6% growth for 2007. Basically, the forecast is for strong growth throughout the economy, except for the U.S. housing market.

2.9% is a decent number, especially if inflation remains tame. So maybe Bernanke and his Fed colleagues have raised rates to just the right level, i.e. the neutral rate (the neutral rate is a Fed Funds Target Rate that neither stimulates nor inhibits U.S. economic growth, and is the rate that's associated with a stable U.S. economy.)

Or, maybe not.

Maybe today's Fed Funds Target Rate of 5.25% is a bit above neutral, which would mean that the Fed may elect to lower the Fed Funds Target to 5% some time next year. That's what investors are thinking.

When investors foresee an economic slowdown ahead, they tend to move their money from stocks to the relative safety of government treasuries. As the demand for e.g. 10-year treasury notes rises, the yield on the 10-year note -- i.e. the interest paid to the investor -- falls (and vice versa.)

Treasury yields are great indicators of where the economy is headed, especially when the yield on the ten-year note is compared to the Federal Funds Target Rate. If the yield on the 10-year note is trending lower than the Fed Funds Rate Target, then it's a pretty safe bet that the economy will be slowing in the coming months. The difference between the Fed Funds Target Rate and the 10-year treasury yield is known as the "spread."

The last time the Fed started cutting interest rates (so as to spur economic growth) was on January 3, 2001; on that day, the Fed Funds Target Rate was 6%, and the yield on the 10-year treasury note was 4.92%. That's a spread of 1.08 percentage points.

Right now, the spread is 0.792 percentage points, and it's been widening ever since June 29, 2006; June 29 was the date of the last Fed rate hike. Here's a chart to demonstrate the current trend:

If the gap between the 10-year treasury note yield and the Fed Funds Target Rate continues to widen, then the U.S. economy is more likely to cool in the coming months, which, in turn, would make it more likely that the Fed will elect to lower interest rates in 2007.

The Latest Odds

As of right now, the investors who trade in Fed Funds Futures have odds at around 79% (according to current pricing on contracts) that the Federal Open Market Committee (FOMC) will elect to lower the benchmark Fed Funds Target Rate by 25 basis points at the March 21ST, 2007 monetary policy meeting.

Summary of the Latest Prime Rate Predictions:

- In all likelihood, the Prime Rate will remain at the current 8.25% after the December 12TH and January 31ST FOMC monetary policy meetings.

- Current odds that the Prime Rate will be cut to

8.00% on March 21ST, 2007: 79% (somewhat likely)

- NB: Prime Rate = (The Fed Funds Target Rate + 3)

The odds related to Fed Funds Futures contracts -- widely accepted as the best predictor of where the FOMC will take the benchmark Fed Funds Target Rate -- are continually changing, so stay tuned for the latest odds. Odds may experience a significant shift on the release of the following economic report:

- Friday, December 8, 2006: The Labor Department releases the Employment Situation report for November.

Labels: odds, prime_rate_forecast

|

--> www.FedPrimeRate.com Privacy Policy <--

--> www.FedPrimeRate.com Privacy Policy -- BACKUP<-- CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

<< Home