Odds Now At 100% (Certain) The U.S. Prime Rate Will Rise to 8.50% After This Afternoon's FOMC Monetary Policy Meeting

|

| Prime Rate Prediction |

Prime Rate Forecast

As of right now, our odds are at 100% (certain) the Federal Open Market Committee (FOMC) will vote to raise the benchmark target range for the fed funds rate to 5.25% - 5.50% at today's monetary policy meeting, with the United States Prime Rate (a.k.a Fed Prime Rate) rising to 8.50%.

=======

Many economists keep warning that a recession may be in the offing, but working America and consumer America are in defiance.

Employment remains very strong, while the latest Consumer Confidence reading (for this month) proves that Americans are still spending like...Americans.

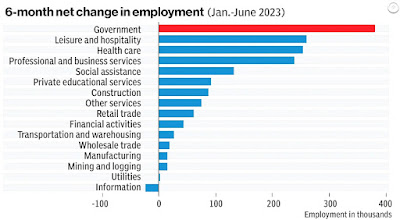

Interesting note: Since the beginning of this year, government has been hiring more than any other sector. :o(

Stay tuned...

Employment remains very strong, while the latest Consumer Confidence reading (for this month) proves that Americans are still spending like...Americans.

Interesting note: Since the beginning of this year, government has been hiring more than any other sector. :o(

Stay tuned...

============

NB: U.S. Prime Rate = (The Fed Funds Target Rate + 3)

=======

Current Odds

- Current odds the U.S. Prime Rate will rise to 8.50% after today's FOMC monetary policy meeting: 100% (certain.)

=========

Labels: banking, banks, disinflation, fed_funds_target_rate, Fed_Prime_Rate, housing, Housing_Inflation, inflation, LIBOR, LIBOR_Transition, money, odds, prime_rate, prime_rate_forecast, prime_rate_prediction

|

--> www.FedPrimeRate.com Privacy Policy <--

--> www.FedPrimeRate.com Privacy Policy -- BACKUP<-- CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

0 Comments:

Post a Comment

<< Home