Prime Rate Increase Today: U.S. Prime Rate Is Now 7.75%

Today's rate increase by The Fed comes as no surprise to the business, banking, academic and investment communities, as today's 25 basis point (0.25 percentage point) increase to The Federal Funds Target Rate was fully expected.

The Federal Open Market Committee (FOMC) of The Federal Reserve today voted to raise their Fed Funds Target Rate to 4.75%. Therefore, as of this afternoon, the US Prime Rate is now 7.75%, the highest it's been in 5 years. Many American banks have already issued a press release announcing that their prime lending rate has increased from 7.5% to 7.75%, including:

What's Ahead for the Prime Rate

Low unemployment coupled with strong economic growth and high energy prices are all placing inflationary pressure on the nation's economy. High energy costs--and, of course, we are talking about crude oil here--continue to threaten to "pass through" and cause a general price increases for both consumers and producers. Right now, NYMEX crude oil for future delivery is at a staggering $65.94 per barrel, and no one knows when the political tensions in the Middle East and Africa are going to simmer down.

Today was Dr. Ben Bernanke's debut as the FOMC boss, so rate watchers, economists, academics, investors--anyone and everyone with an interest in the U.S. economy--are all scrutinizing the press release that was issued by The Fed today with much fervor. Many rate watchers are going to be pleased about the wording in today's release, as the comments contain language that provides some useful insight as to future interest rate decisions that will be made by the FOMC:

Yup, good stuff, because the statement about future policy is virtually identical to the one that can be found in the January 31, 2006 FOMC press release when Alan Greenspan was still calling the shots, and I think lots of folks like the idea that Bernanke is probably making an effort to emulate Dr. Greenspan's approach to U.S. economic stewardship.

We can tell by the above language that if the economy continues to move ahead at a healthy pace, and other factors like low unemployment and high energy prices continue to place inflationary pressure on the economy, then we should expect another 25 basis point increase to the Federal Funds Target Rate after the FOMC adjourns on May 10th, 2006; a Fed Funds Rate of 5% after May 10th, 2006, would translate to a national Prime Rate of 8%, because the Prime Rate can be expressed as:

Prime Rate Prediction: The Latest Odds from Fed Funds Futures Traders

The investors who trade in Federal Funds Futures have shifted the odds--according to current pricing--of another quarter point hike to the Fed Funds Rate following today's statement by The FOMC: odds of another 0.25 percentage point increase have gone from 76% to 90%. So, according to current pricing on Federal Funds Futures, we should expect a U.S. Prime Rate of 8% after the FOMC adjourns on May10th, 2006.

The odds related to Fed Funds Futures trade are continually changing, so stay tuned for the latest odds, especially when The FOMC releases the minutes from today's meeting, which should happen on April 18th, 2006.

Here's a snippet from the press release that was issued by The Fed today:

The Federal Open Market Committee (FOMC) of The Federal Reserve today voted to raise their Fed Funds Target Rate to 4.75%. Therefore, as of this afternoon, the US Prime Rate is now 7.75%, the highest it's been in 5 years. Many American banks have already issued a press release announcing that their prime lending rate has increased from 7.5% to 7.75%, including:

- The Bank of America*

- The Bank of New York*

- PNC*

- Comerica Bank*

- Wells Fargo*

- Wachovia*

- KeyCorp*

- SunTrust*

- U.S. Bancorp*

- Sky Financial Group*

- M&T Bank*

What's Ahead for the Prime Rate

Low unemployment coupled with strong economic growth and high energy prices are all placing inflationary pressure on the nation's economy. High energy costs--and, of course, we are talking about crude oil here--continue to threaten to "pass through" and cause a general price increases for both consumers and producers. Right now, NYMEX crude oil for future delivery is at a staggering $65.94 per barrel, and no one knows when the political tensions in the Middle East and Africa are going to simmer down.

Today was Dr. Ben Bernanke's debut as the FOMC boss, so rate watchers, economists, academics, investors--anyone and everyone with an interest in the U.S. economy--are all scrutinizing the press release that was issued by The Fed today with much fervor. Many rate watchers are going to be pleased about the wording in today's release, as the comments contain language that provides some useful insight as to future interest rate decisions that will be made by the FOMC:

"The Committee judges that some further policy firming may be needed to keep the risks to the attainment of both sustainable economic growth and price stability roughly in balance. In any event, the Committee will respond to changes in economic prospects as needed to foster these objectives."

Yup, good stuff, because the statement about future policy is virtually identical to the one that can be found in the January 31, 2006 FOMC press release when Alan Greenspan was still calling the shots, and I think lots of folks like the idea that Bernanke is probably making an effort to emulate Dr. Greenspan's approach to U.S. economic stewardship.

We can tell by the above language that if the economy continues to move ahead at a healthy pace, and other factors like low unemployment and high energy prices continue to place inflationary pressure on the economy, then we should expect another 25 basis point increase to the Federal Funds Target Rate after the FOMC adjourns on May 10th, 2006; a Fed Funds Rate of 5% after May 10th, 2006, would translate to a national Prime Rate of 8%, because the Prime Rate can be expressed as:

U.S. Prime Rate = The Fed Funds Target Rate + 3

Prime Rate Prediction: The Latest Odds from Fed Funds Futures Traders

The investors who trade in Federal Funds Futures have shifted the odds--according to current pricing--of another quarter point hike to the Fed Funds Rate following today's statement by The FOMC: odds of another 0.25 percentage point increase have gone from 76% to 90%. So, according to current pricing on Federal Funds Futures, we should expect a U.S. Prime Rate of 8% after the FOMC adjourns on May10th, 2006.

The odds related to Fed Funds Futures trade are continually changing, so stay tuned for the latest odds, especially when The FOMC releases the minutes from today's meeting, which should happen on April 18th, 2006.

Here's a snippet from the press release that was issued by The Fed today:

"...The Federal Open Market Committee decided today to raise its target for the federal funds rate by 25 basis points to 4-3/4 percent.

The slowing of the growth of real GDP in the fourth quarter of 2005 seems largely to have reflected temporary or special factors. Economic growth has rebounded strongly in the current quarter but appears likely to moderate to a more sustainable pace. As yet, the run-up in the prices of energy and other commodities appears to have had only a modest effect on core inflation, ongoing productivity gains have helped to hold the growth of unit labor costs in check, and inflation expectations remain contained. Still, possible increases in resource utilization, in combination with the elevated prices of energy and other commodities, have the potential to add to inflation pressures.

The Committee judges that some further policy firming may be needed to keep the risks to the attainment of both sustainable economic growth and price stability roughly in balance. In any event, the Committee will respond to changes in economic prospects as needed to foster these objectives.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Susan S. Bies; Jack Guynn; Donald L. Kohn; Randall S. Kroszner; Jeffrey M. Lacker; Mark W. Olson; Sandra Pianalto; Kevin M. Warsh; and Janet L. Yellen..."

Labels: fomc, fomc_meeting, prime_rate_forecast, prime_rate_increase

|

--> www.FedPrimeRate.com Privacy Policy <--

--> www.FedPrimeRate.com Privacy Policy -- BACKUP<-- CLICK HERE to JUMP to the TOP of THIS PAGE > SITEMAP < |

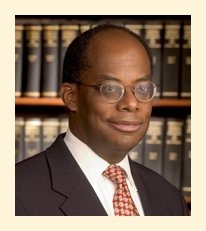

when the terrorist attacks of September 11, 2001 happened: Ferguson was the only Fed governor in Washington, D.C. during the attacks (Alan Greenspan was vacationing in Switzerland at the time); Ferguson was at his post, and doing his job very well, providing liquidity for the nation's markets during that economically stressful time. The day after the September 11 attacks, the Fed loaned $46 billion to commercial banks around the country, which, at the time, was more than 200 times the daily overnight loan average.

when the terrorist attacks of September 11, 2001 happened: Ferguson was the only Fed governor in Washington, D.C. during the attacks (Alan Greenspan was vacationing in Switzerland at the time); Ferguson was at his post, and doing his job very well, providing liquidity for the nation's markets during that economically stressful time. The day after the September 11 attacks, the Fed loaned $46 billion to commercial banks around the country, which, at the time, was more than 200 times the daily overnight loan average.